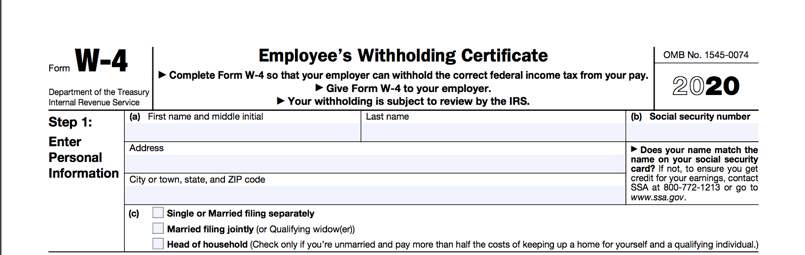

5 Steps of 2020 Form W-4

Step 1. Demographic information - The biggest difference here is that employees can now claim “Head of household” as a filing status.

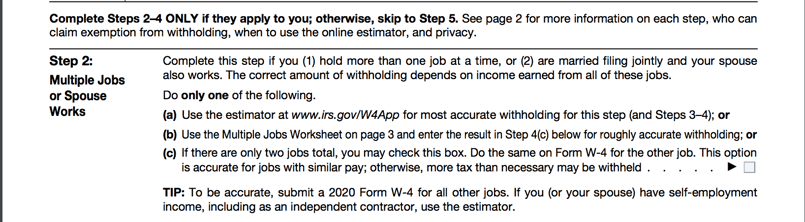

Step 2. Multiple jobs - Employees can choose to complete the included worksheet or use the online IRS calculator to determine the amount to enter on line 4c. There is also a third option to check the box at the end of this section if applicable. Checking this box will result in a larger amount to be withheld from the employee's paycheck but very little chance of too little being withheld.

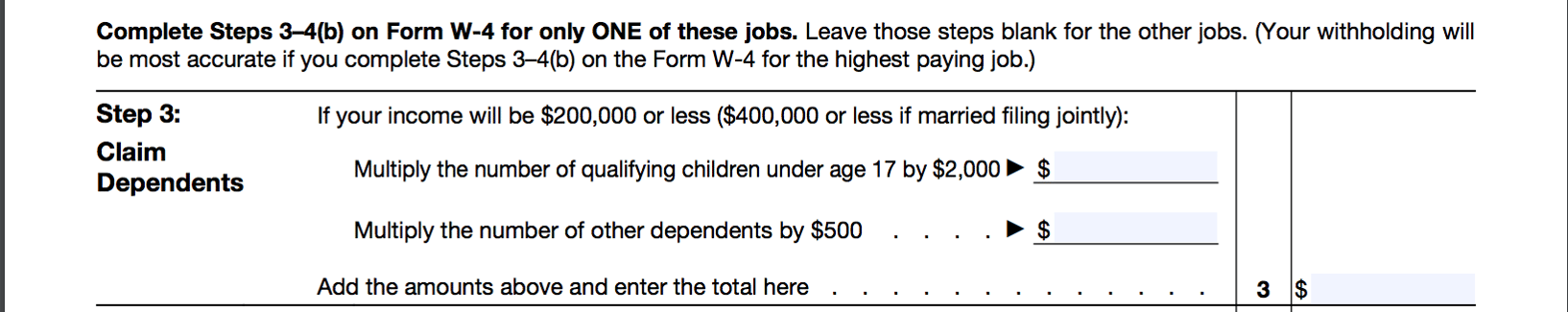

Step 3. Dependents and tax credits - Claim your dependents by multiplying the number of qualifying children under the age of 17 by $2,000 and the number of any other dependents by $500. This section only applies if your income will be $200,000 or less or $400,000 or less if married filing jointly.

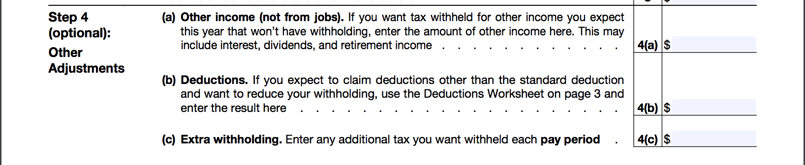

Step 4. Other adjustments - Enter information on other income (not including income from a job), deductions, and exemption. If planning to claim deductions outside of the standard deduction, employees will need to complete Worksheet 2.

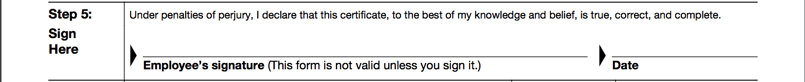

Step 5. Sign and date

As stated above, employees will not be required to file a new W-4 once the form goes into effect. However, after December 31, 2019, W-4’s prior to 2020 will not be accepted for new hires and employers must enforce this.

Leave a Comment